Whether you choose to call it an Income Statement, a Profit and Loss Statement, Balance Sheet, Cash Flow Statement, or whatever you want, this accounting tool will be your best friend and optimize your business.

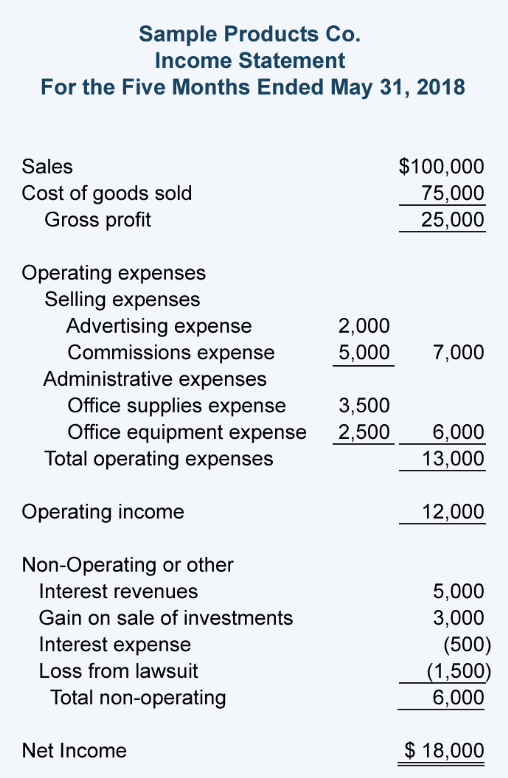

Let’s start by taking a look at a typical income statement:

An income statement is a powerful tool meant to show how something very simple: how you’re making money! At the top of our income statement, we see “Sales.”

Sales of your good and/or service drive growth and profit, and are crucial to track. By subtracting the cost of selling your goods/services, you will find your gross margin. Gross profit will pay for all your overhead and costs of running a business!

The next portion of your income statement shows your operating expenses–what it typically takes to run your business. These expenses include labor costs (which will be discussed later on).

After subtracting your operating expenses from your gross profit, you’ll reach your operating income.

Finally, non-operating revenues and expenses are non-typical costs or benefits that are not directly tied to your business and occur on a variant basis.

Upon subtracting (or adding) your non-operating, you’ll find your net income and total revenue!

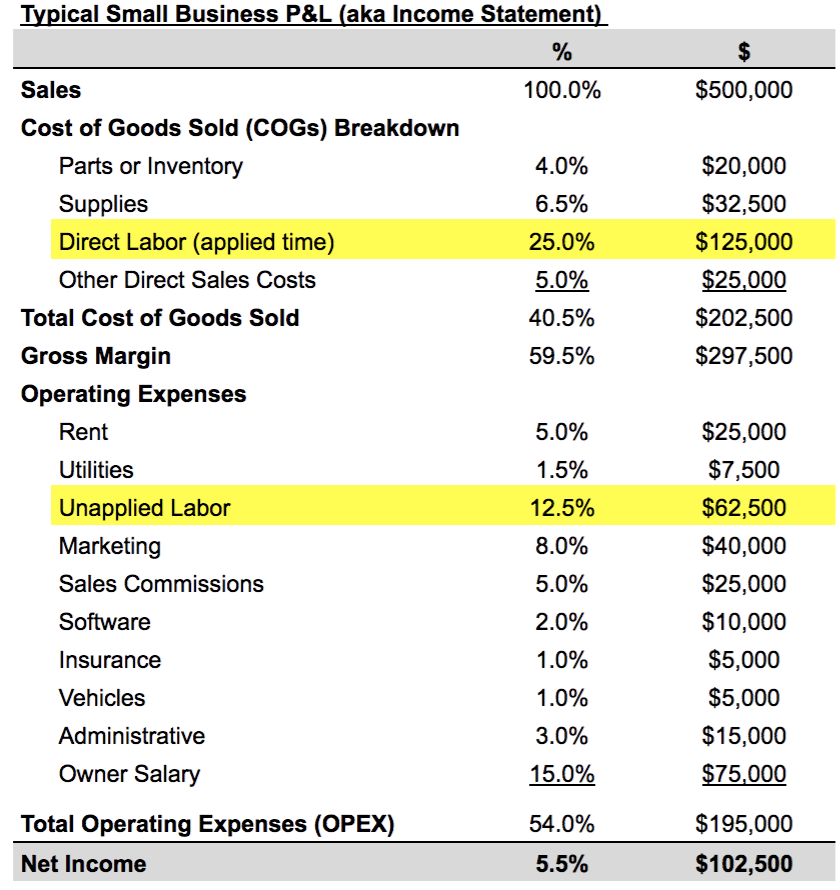

Now, let’s revisit your income statement, but this time with a new, powerful tool at your disposal: Punchey.

Punchey’s unique software will completely revolutionize your income statement for the better.

Let’s take a look at a typical income statement with Punchey:

One key difference we see in this income statement is the discretion used to differentiate unapplied and applied labor. This a crucial distinction for businesses to make and can make you lots of money, especially with flat-rate employees.

Applied labor can be considered a cost of the goods sold, since it is a direct cost towards selling your product. Without the labor, the good would not be able to be sold.

Unapplied labor, however, does not play a role in the sale of your product, thus it must be considered an operating expense and be differentiated. This wasted time could break your business and is important to track and register correctly.

The bad news is that unapplied labor can be a bit of a tricky problem not only to tackle, but even to identify (learn more about why unapplied labor costs can be so high).

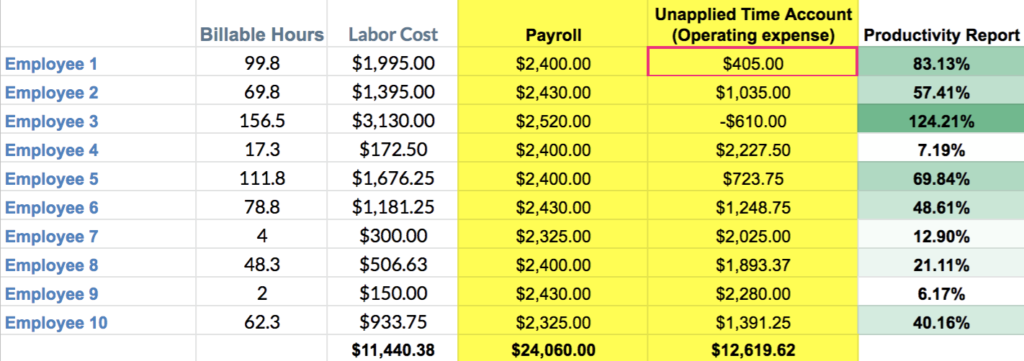

The good news is that Punchey’s software will track billable hours and labor cost for you to simplify your life! After pulling Punchey’s report, with some easy Excel mechanics, you can find your unapplied time expenses.

Let’s pull a Punchey report to see where these costs came from:

Here, we see billable hours and labor cost, pulled directly from Punchey’s software. These two data points track how much money each employee’s labor is generating and the productivity of their hours.

By then subtracting your payroll from labor cost, you will be able to find the Unapplied Time Account.

Now you can find each worker’s productivity report, efficiency, and better manage your income statement by finding unapplied labor.

Moving back to your income statement, place your applied labor (payroll minus unapplied labor) in the cost of selling your product and unapplied labor under operating expenses.

This will give you a better understanding of your business, where you can cut costs (learn more about the benefits of flat-rate employees), and help you to maximize profits.