Learning the difference between cash and accrual accounting is a pivotal tool for customizing your business. With knowledge of both options in mind, you can make the best choice for your business.

The difference between these two methods is the timing of when sales and purchases are recorded in your accounts.

Cash Basis Accounting

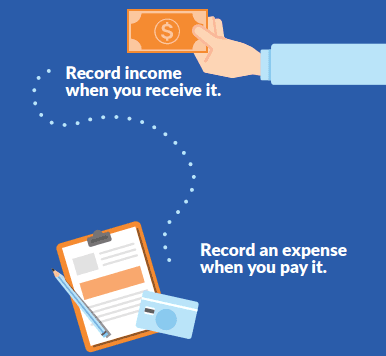

Cash accounting recognizes revenue and expenses only when money changes hands. This means that you do not count a sale until the transaction is processed and compensation is received.

This method does not recognize accounts receivable or accounts payable.

Cash basis accounting is particularly helpful for small businesses because it is easier to maintain and log. To test whether a transaction has occurred in this case, you just need to check how much money is in your bank.

This is also beneficial because it makes it easier to see how much cash your business actually has at any given time.

Finally, the business’s income will not be taxed until the money is in the bank, as transactions are not recorded until this point.

Accrual Basis Accounting

Accrual accounting differs from cash basis accounting at the time of recording.

This method records revenues and expenses when they are earned, regardless of when the money is actually received. The benefit of using this method is that it provides a more realistic idea of income and expenses in a given period of time. It provides a long-term picture that cash accounting does not.

The downside of this is that accrual accounting does not provide any awareness of cash flow. It can make an empty bank account seem exceptionally profitable.

Without careful monitoring of cash flow, accrual accounting can have devastating consequences.

The Impact

The best way to show the impact on these two methods is through an example.

Imagine you have had the following transactions over the last week:

- Sent an invoice for $1,000 completed earlier this month.

- Paid $100 in fees for a received bill.

- Received $5,000 from a client for a project that was invoiced last month.

- Received a bill for $2,500.

Using the cash basis method, profit for this month would be $4,900 ($5,000 received minus $100 paid).

Using the accrual method, profit for this month would be $3,400 ($6,000 in income minus $2,600 in bills).

Additionally, your choice of accounting method would impact taxation. If you use the accrual method, you’d be taxed immediately rather than after receiving payment.

Choosing a Method

Depending on the business, both of these can be great options. For smaller businesses, the cash basis method is likely the most helpful, while larger businesses could benefit from the accrual method.

Some businesses, however, are required to use the accrual method.

If you’d like to change accounting methods, you need to file Form 3115 to get approval from the IRS.